Form 1040x Amended Tax Return 2015

File using paper form. Mail the form 1040 x to the address listed in the form s instructions pdf.

Preparing Form 1040x In Lacerte From A Filed Return Client File And From Scratch Tax Pro Center Intuit

Preparing Form 1040x In Lacerte From A Filed Return Client File And From Scratch Tax Pro Center Intuit

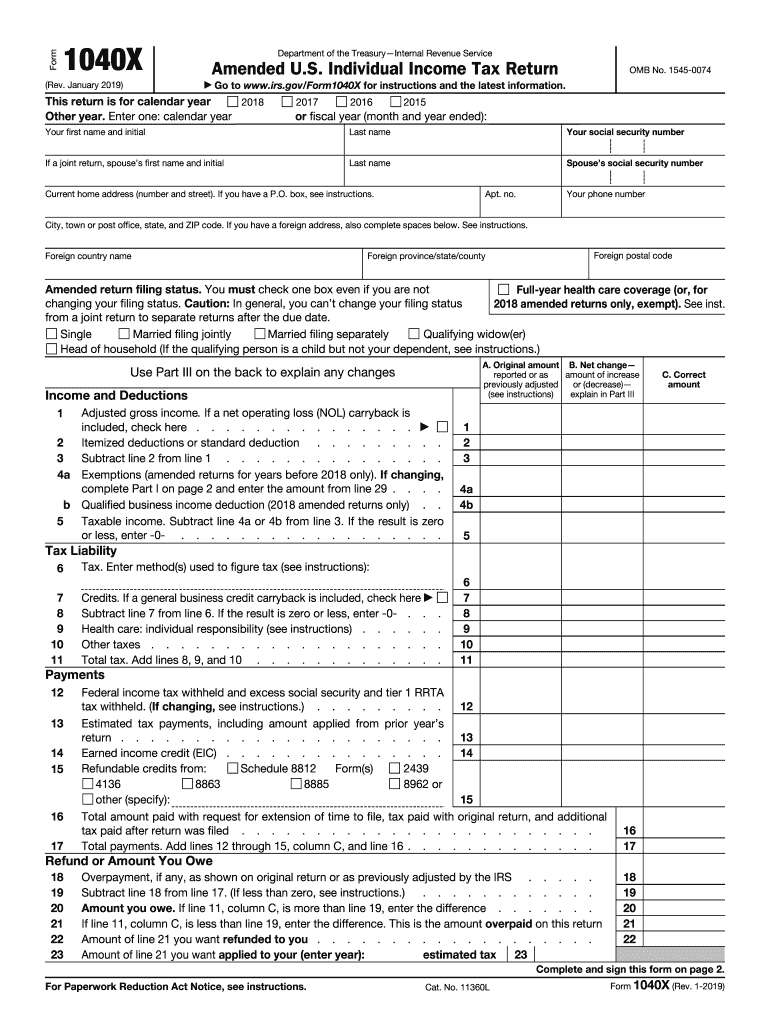

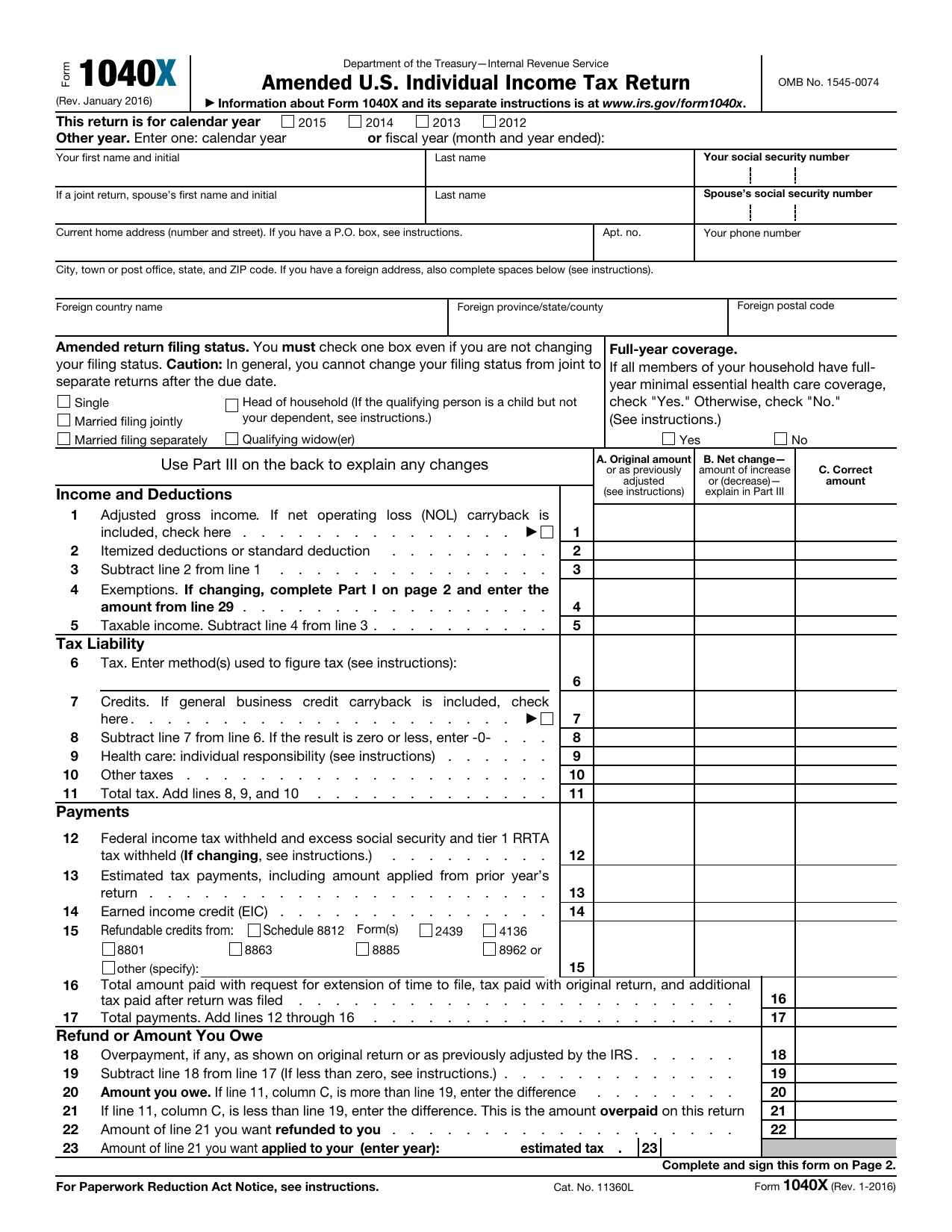

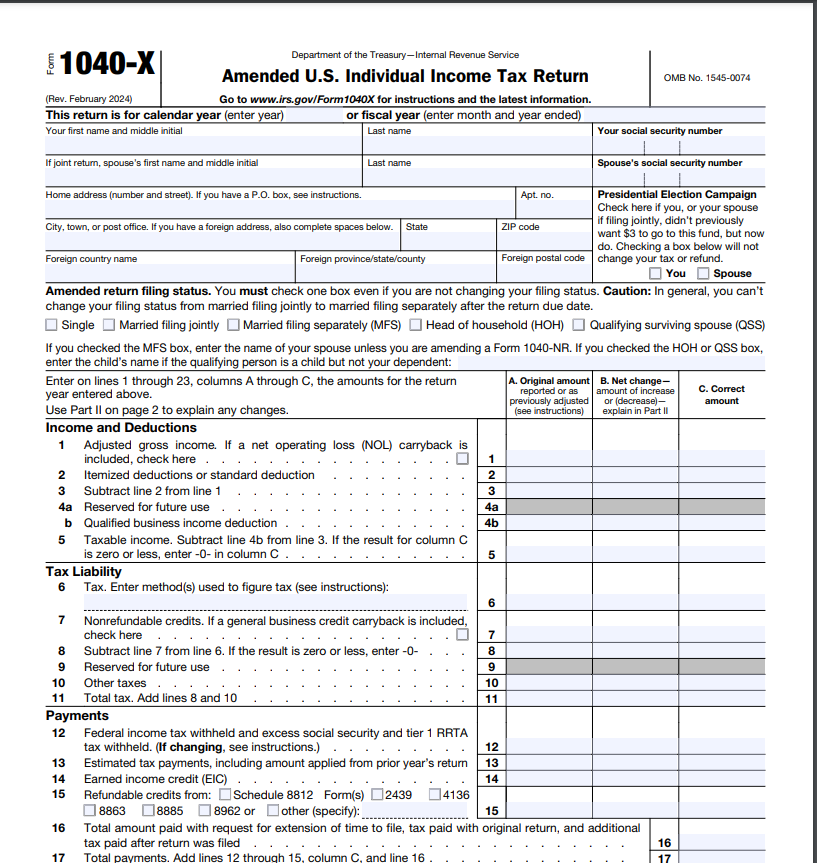

Amending is done on form 1040x.

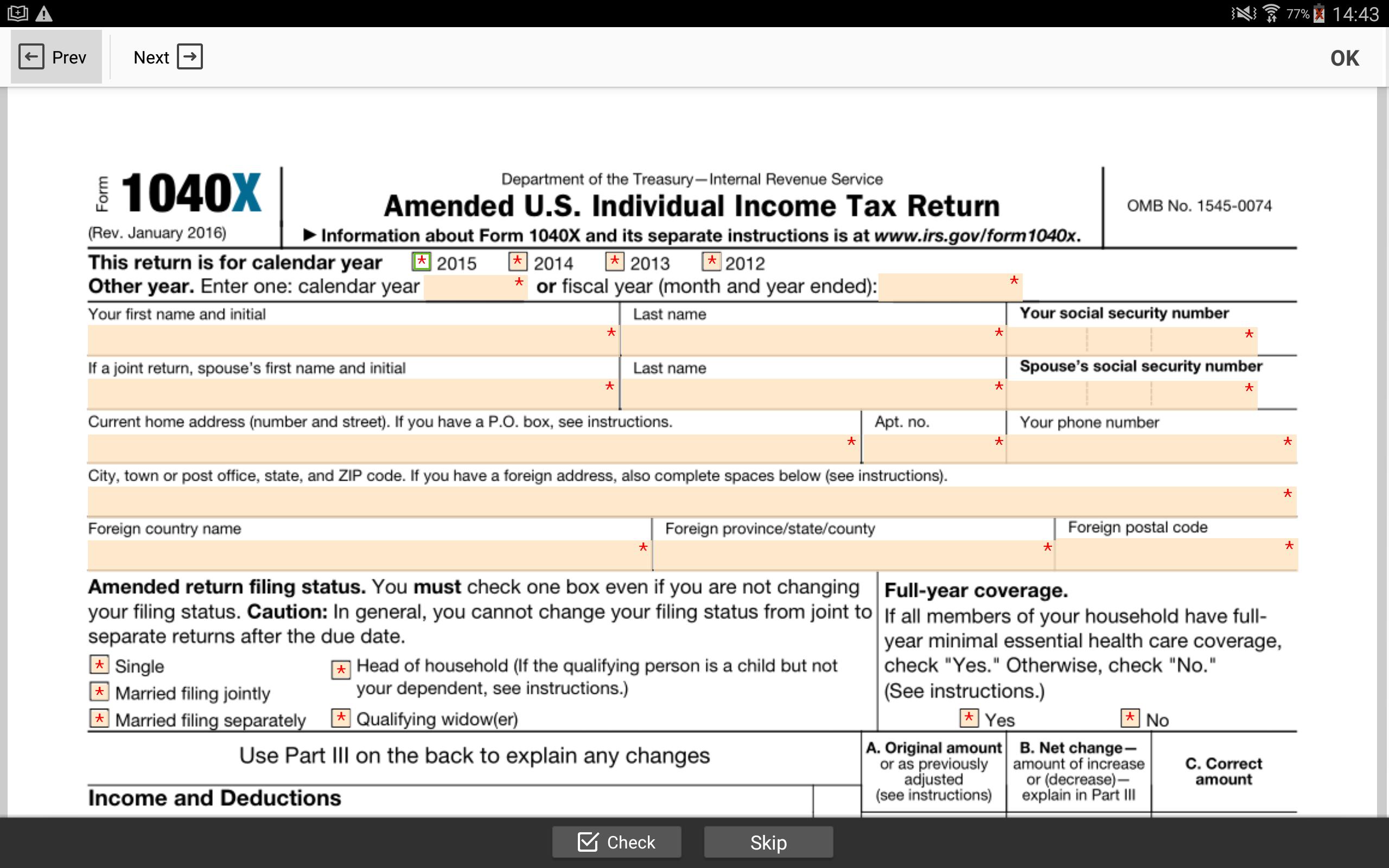

Form 1040x amended tax return 2015. If more than 4 dependents see inst. Amended returns cannot be e filed. Individual income tax return for this year and up to three prior years.

Use form 1040 x to file an amended tax return. Individual income tax return information about form 1040x and its separate instructions is at www irs gov form1040x. Calendar year or fiscal year month and year ended.

These would be any forms created in the return due to the changes made or any documentation that would support the changes made e g. Check the status of your form 1040 x amended u s. Individual income tax return.

If you are using the free federal edition you will be prompted to upgrade your return when you go to access the amendment section of the q a. For additional instructions and mailing addresses please see the irs instructions for form 1040x. Individual income tax return including recent updates related forms and instructions on how to file.

1040nr ez will be used regardless of the tax year being discussed. If your filing status is married filing. Do not file a second tax return or call the irs.

January 2017 department of the treasury internal revenue service. Individual income tax return information about form 1040x and its separate instructions is at. Form 1040x is used by individual taxpayers to amend prior year tax returns.

File a 2015 1040x amended return. Also if your return is accepted you should not try to amend your return until it has been fully processed and you have received your refund or your payment has cleared. That form should be available for amending 2015 returns mid february.

Taxpayers can t file amended returns electronically. Information about form 1040 x amended u s. January 2016 department of the treasury internal revenue service amended u s.

Dependents children and others claimed on this amended return. If amending your 2018 or later return leave line blank. You can use this form if you were born before january 2 1955.

Individual income tax return to correct errors to an original tax return the taxpayer has already filed. 1545 0074 this return is for calendar year 2015 2014 2013 2012 other year. Use form 1040 x amended u s.

The form generally mirrors form 1040. The irs offers tips on how to amend a tax return. Tax return for seniors was introduced in the 2019 tax year.

Federal form 1040x amended return 2015 2016 or 2017 federal amendments can only be completed with taxact s plus or premium programs 2016 2017 returns. Enter the result here and on line 4a on page 1 of this form.

Publication 570 2019 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

Publication 570 2019 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

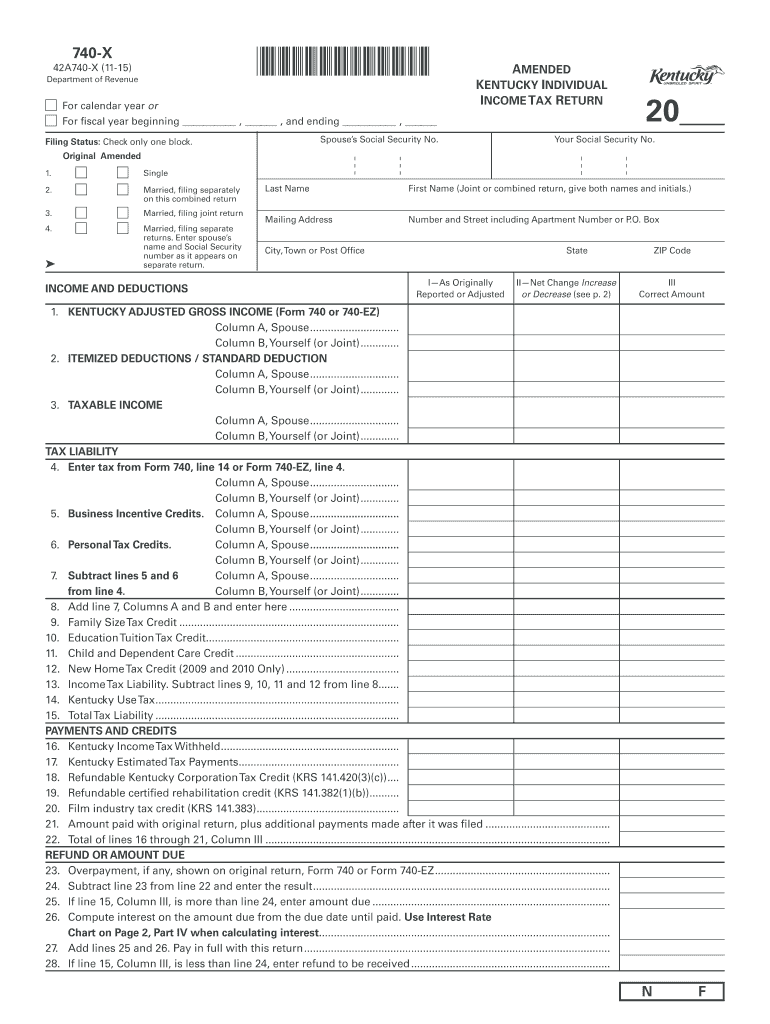

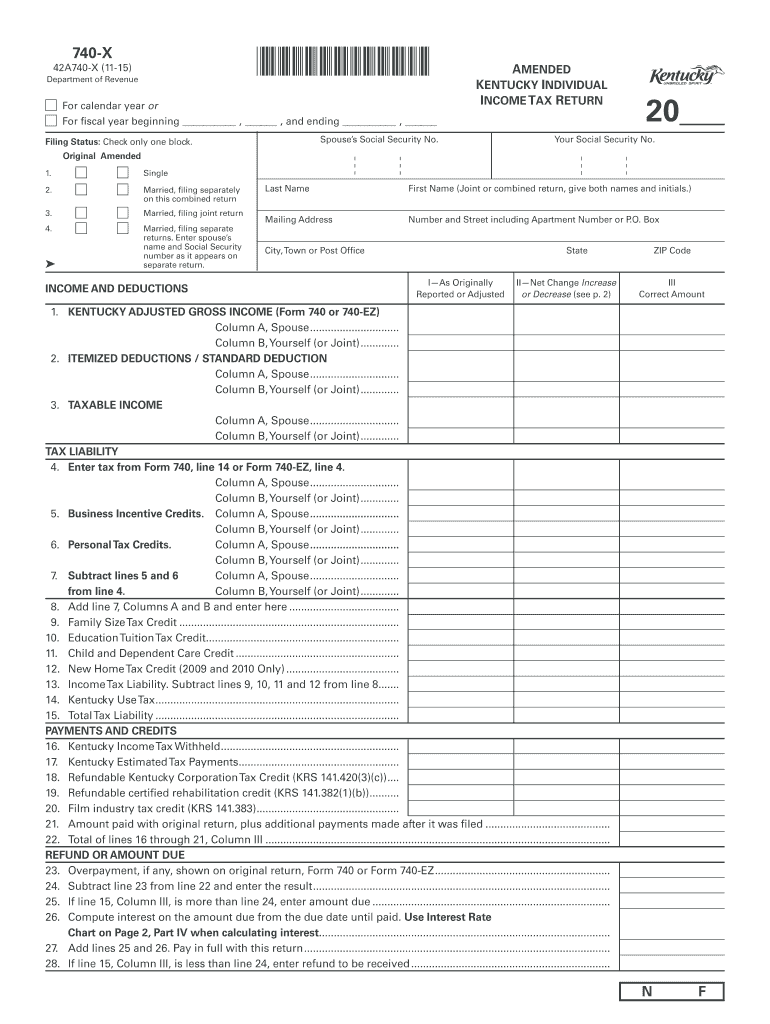

2015 Form Ky Dor 740 X Fill Online Printable Fillable Blank Pdffiller

2015 Form Ky Dor 740 X Fill Online Printable Fillable Blank Pdffiller

Correcting Mistakes After You File Amended Tax Returns

Correcting Mistakes After You File Amended Tax Returns

Must Know Tips For Filing Amended Tax Returns

Must Know Tips For Filing Amended Tax Returns

Https Portal Ct Gov Media Drs Forms 1 2015 Incometax Ct1040xpdf Pdf La En

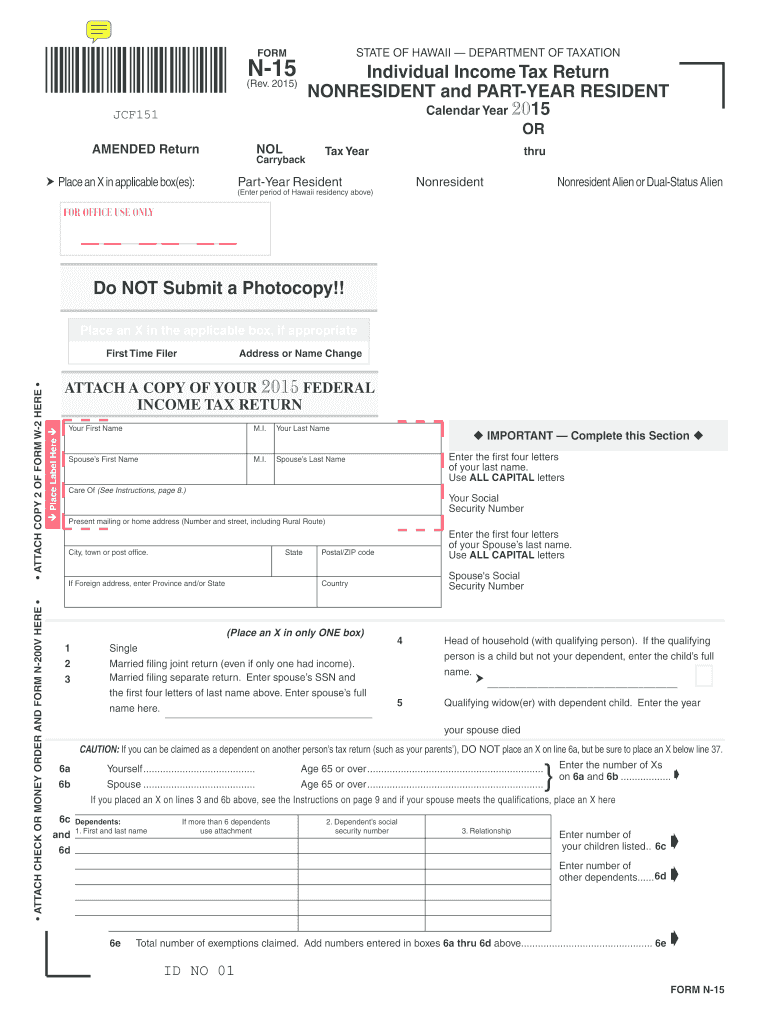

Hawaii Form N 15 Instructions 2019 Fill Out And Sign Printable Pdf Template Signnow

Hawaii Form N 15 Instructions 2019 Fill Out And Sign Printable Pdf Template Signnow

Form 1040x For Irs Sign Personal Income Tax Eform For Android Apk Download

Form 1040x For Irs Sign Personal Income Tax Eform For Android Apk Download

Publication 908 02 2020 Bankruptcy Tax Guide Internal Revenue Service

Publication 908 02 2020 Bankruptcy Tax Guide Internal Revenue Service

Irs 1040 X 2019 Fill And Sign Printable Template Online Us Legal Forms

Irs 1040 X 2019 Fill And Sign Printable Template Online Us Legal Forms

Pin By Amber Shramek On Financing Budget Budgeting Finances Informative Tax Return

Pin By Amber Shramek On Financing Budget Budgeting Finances Informative Tax Return

Form 1040 X Amended U S Individual Income Tax Return

1040 X Amended U S Individual Income Tax Return

1040 X Amended U S Individual Income Tax Return

/ScheduleB-InterestandOrdinaryDividends-c6ff80bf2c1f4de981e0b0625a4e3dc7.png) Who Needs To Fill Out Irs Form Schedule B

Who Needs To Fill Out Irs Form Schedule B

Should I Ammend My Tax Return The How Why And When

Should I Ammend My Tax Return The How Why And When

Https Forms In Gov Download Aspx Id 7583

Form 1040x Amended Personal Income Return For Form 1040 Youtube

Form 1040x Amended Personal Income Return For Form 1040 Youtube

Komentar

Posting Komentar